While some policyholders will experience a decrease under the new methodology, others will experience an increase that is commensurate with their full risk rate. Under the previous methodology, all policyholders received annual increases year after year without knowing their full risk rate.

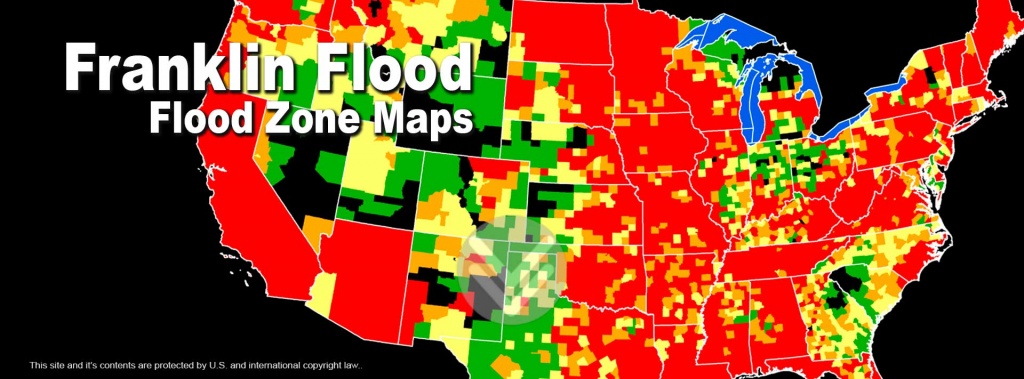

#Flood insurance cost texas code

Sharing Information with the PublicįEMA has shared information about the new methodology on that explains in detail the rating system methodology as well as providing rate impacts at the state, county and ZIP code level. These policyholders with older pre-Flood Insurance Rate Map homes have some of the highest rates in the nation under the current rating methodology. 1, about 23% - or more than 1 million - policyholders will see a decrease in their premium at the time of their policy’s renewal. Under the legacy pricing system, every policyholder would have seen rate increases now and into the future. The new methodology considers the cost to rebuild along with several other flood variables to determine a property’s true flood risk. In addition, the new rating methodology has exposed inequities in pricing whereby some policyholders have been unjustly subsidizing other policyholders. By doing so we empower policyholders to make informed decisions to protect their homes and businesses from life-changing flooding events that will strike in the months and years ahead due to climate change.”Īlso known as Risk Rating 2.0, the new methodology uses increased technological and mapping capabilities to determine and communicate a property’s full flood risk. “Now is the right time to modernize how risk is identified, priced and communicated. “The NFIP’s new rating methodology is long overdue since it hasn’t been updated in more than 40 years,” said David Maurstad, senior executive of the National Flood Insurance Program. Potential and existing policyholders can learn their specific rates with a call to their insurance company or agent.

To date, FEMA has provided more than 2.8 million quotes and trained 20,792 agents. New policies will be sold using the new methodology, and some existing policyholders may be eligible for immediate premium decreases when their policy renews. The new premiums are the result of the program’s new pricing methodology delivering rates that are actuarily sound, equitable, easier to understand and better reflect an individual property’s flood risk.

1, FEMA’s National Flood Insurance Program (NFIP) will begin to offer more equitable and risk informed rates.

0 kommentar(er)

0 kommentar(er)